Would you spend 70% of your income on rent?

Only five per cent of rental properties are affordable for those on income support

It is harder than ever for low income families to find affordable housing, according to a new report released by Anglicare.

The Anglicare Rental Affordability Snapshot is a collaborative project by all the state branches of Anglicare, and highlights the lived experience of looking for housing while on a low income.

“It’s becoming increasingly hard for people on low incomes to afford to pay rent in Sydney.” – Sue King, Anglicare Sydney

“There’s always been very little affordable housing for people on government benefits, but these are the worst results we’ve ever had,” says Sue King, director of advocacy at Anglicare Sydney.

“It’s becoming increasingly hard for people on low incomes to afford to pay rent in Sydney.”

But it’s not just Sydney.

The national report uses data from the Australian Bureau of Statistics to determine that a suitable rental is one that costs less than 30 per cent of household income. Of the 67,751 properties available for rent across Australia on the weekend the snapshot was completed (April 1-2, 2017), 3,844 properties were affordable and appropriate for households receiving income support. That number jumps to 20,239 for households on the minimum wage.

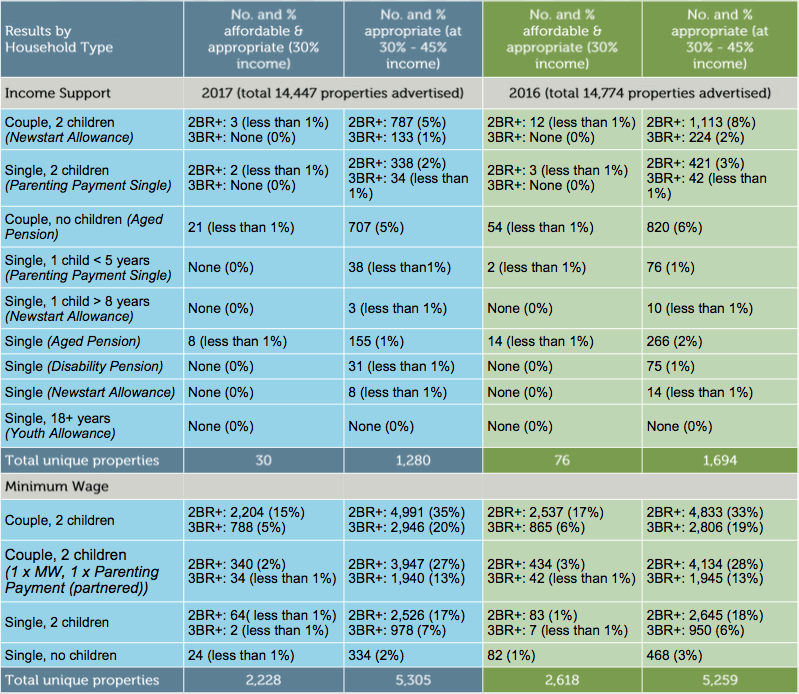

In the greater Sydney area, the statistics are worse. For any given household receiving income support and willing to spend around 30 per cent of its income on rent, there were only 30 properties (out of a possible 14,447 advertised properties) that were affordable and appropriate. If a household was willing to spend up to 45 per cent of its income on rent, the number of affordable properties jumped to 1,280.

If the household was earning minimum wage, and spending 30 per cent of its income on rent, it would have the choice of 2,228 properties. If it was willing to spend up to 45 per cent of it income, it would have the choice of 5,305 properties.

“When you’re on a very low income that means there is very little left for food and bills.” – Sue King, Anglicare Sydney

With numbers like this, King says, “their choices are to pay 50, 60, or 70 per cent of their income to rent privately, and when you’re on a very low income that means there is very little left for food and bills.”

“It’s really pushing people into poverty and into hardship. The private rental market is unsustainable for people on low incomes.”

The state of the rental market in the greater Sydney area Anglicare Sydney

Even typically cheaper suburbs are feeling the pinch.

“Two bedrooms in Bankstown cost $480 per week,” says Gaby Kobrossi, the minister at Bankstown District Uniting Church, in Sydney’s southwest.

“If you have a couple with a baby, they will get each fortnight around $1100 from Centrelink. If you want to find a property for $480 per week, then you have to live with $200 per fortnight. You have to pay electricity, water bills, and food. It’s terrible.”

Kobrossi tells the story of a family who applied to rent a four-bedroom house in North Toongabbie, in Sydney’s west. Over the course of a week, the real estate agent contacted them three times to raise the rent from $540 to $640 per week.

“So, rent is becoming like an auction,” Kobrossi says.

As Kobrossi has done in the past, he contacted the real estate agent on behalf of the family. He was able to get the rent lowered to $580 per week. “The real estate agent knows me and I said to them, ‘I know these people.’

“We always talk to the real estate agents and say, ‘We know these people. We recommend them to you. We promise we will help them to keep the property in good condition.’”

Anglicare is advocating to state and federal governments that there should be significant shifts and changes in policy on housing, including a coordinated approach to public housing.